A new campaign circulating across LA calls on residents to support a so-called “Vacation Rental Revenue Plan,” claiming the move would fund essential city services in the wake of budget cuts. But housing researchers and tenant advocates warn that the campaign is a misleading effort backed by Airbnb to weaken the city’s short-term rental laws ahead of a wave of mega-events that promise to generate massive tourist demand.

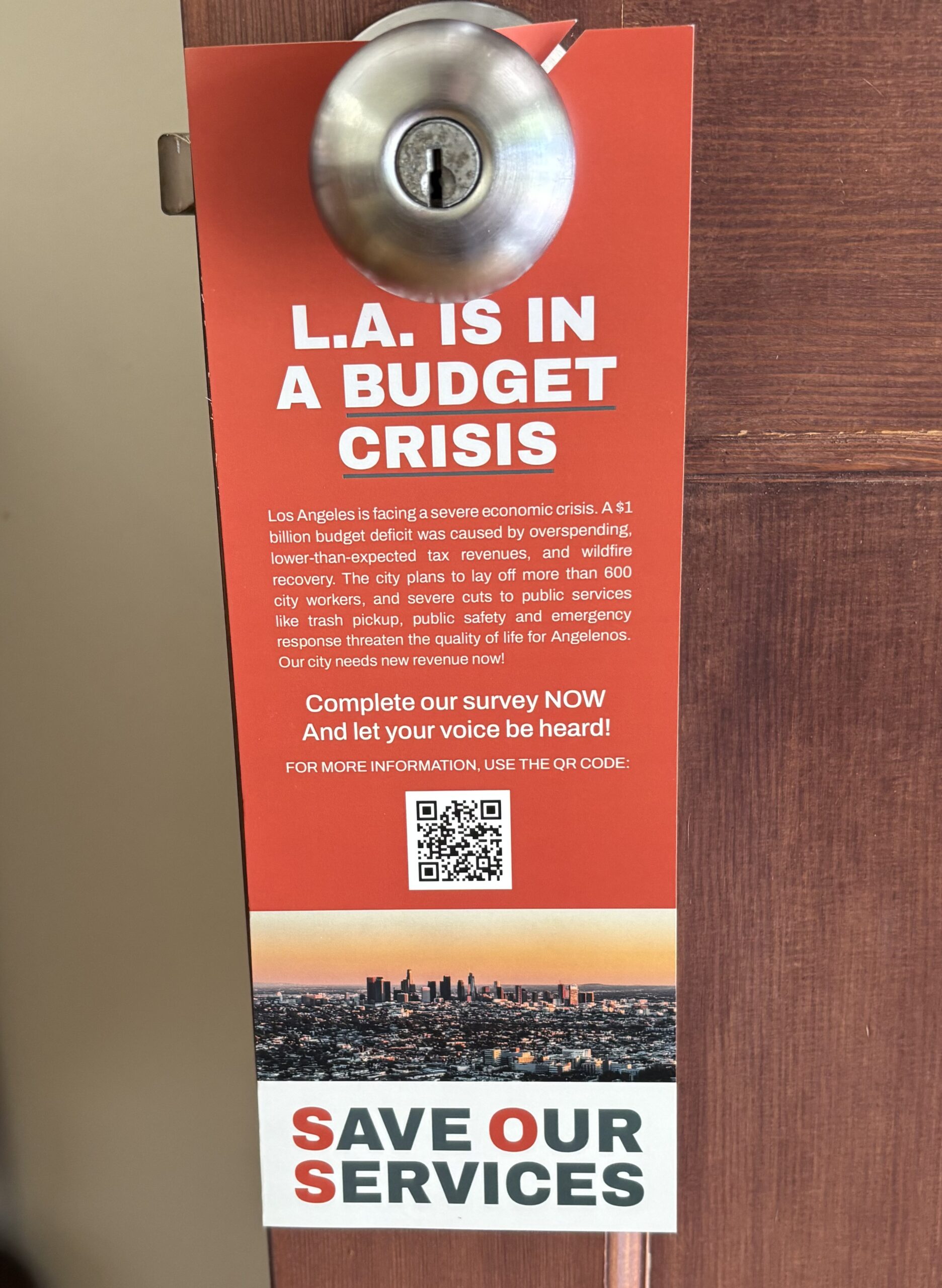

The flyers, which make no mention of Airbnb, frame the proposal as a local response to the city’s budget crisis. They argue that allowing second homes to be used as vacation rentals could generate up to $80 million annually in tax revenue, just in time for the 2026 World Cup, 2027 Super Bowl, and 2028 Olympics.

However, a growing chorus of critics say the plan is designed to benefit landlords and investors eager to profit from these events by turning housing into tourist accommodations. Under the city’s Home-Sharing Ordinance, only a host’s primary residence can legally be rented short-term. The proposed changes would roll back that core protection, making it easier for corporate landlords to convert entire buildings into short-term rentals.

A 2022 study by McGill University found that commercial short-term rentals have already removed at least 2,500 homes from Los Angeles’ long-term housing market. According to the study, STRs have raised average rents by $810 per year and are responsible for over 5,000 additional people experiencing homelessness in the city each night. The impact has not been evenly distributed. Neighborhoods like Venice, Hollywood, and Downtown, which are already grappling with housing affordability, account for a disproportionate share of STR activity. In Venice, short-term rentals have at times consumed over 4% of all housing units.

Despite regulations, enforcement remains weak, with nearly half of all short-term rental listings in Los Angeles operating illegally. In the year leading up to the report, the city issued just $36,500 in fines, despite an estimated $56.8 to $302 million in uncollected penalties from noncompliant listings. Airbnb and other platforms are also costing the city revenue through unpaid taxes. The report estimates up to $14.2 million in uncollected Transient Occupancy Tax and more than $110 million in unpaid state and federal income taxes by STR hosts.

The flyers’ messaging appears carefully crafted to obscure the true purpose of the campaign. A Mar Vista renter who encountered one of the campaign’s canvassers described being told the effort was about restoring city programs for children.

“The canvasser said the campaign was about funding city services that were being cut because of the budget, and he specifically mentioned services for kids,” she said. “He didn’t mention Airbnb at all, and seemed totally unaware that this was about deregulating vacation rentals. This pitch is so off base given what this is really about.”

The report also highlights how economic benefits from STRs overwhelmingly go to a small group of commercial operators. Just 10 percent of hosts earn more than half of all STR income, while many homeowners and tenants see only higher housing costs.

Rather than weakening the law, advocates are calling on the city to strengthen enforcement. Proposals include a private right of action allowing residents to sue illegal STR operators, and an electronic verification system to prevent unregistered listings from going live. With the Olympics and other major events on the horizon, the city can either protect housing for residents, or open the floodgates to unchecked commercial exploitation.