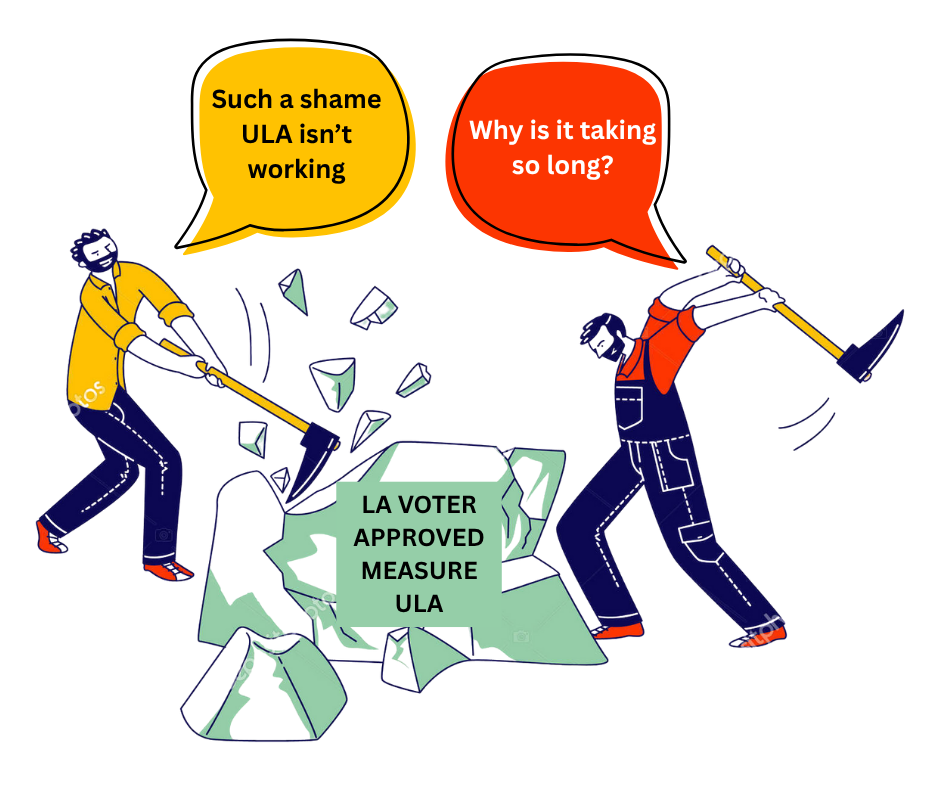

On a recent episode of his podcast What’s Next, Los Angeles?, former Councilmember Mike Bonin hosted a debate about Measure ULA with Joe Donlin of United to House LA and Mott Smith of the Council of Infill Builders. The conversation captured the full spectrum of arguments that have been thrown at ULA since its passage. Donlin laid out the evidence of ULA’s success, while Smith delivered the standard anti-ULA talking points that real estate interests have been pushing. His comments provide a perfect case study, with criticisms that sound convincing at first, but fall apart under scrutiny.

Claim 1: ULA is under-delivering on revenue

The argument: ULA has raised only about half of what supporters projected, proving poor design.

What the record shows: ULA has generated over $830 million in just two years, the largest affordable-housing revenue source in city history, and receipts have climbed quarter after quarter as the market adapts. Donlin emphasizes that this funding is a lifeline amid state and federal cuts and a city budget crunch. The city is on track to hit $1 billion by early 2026. Revenue performance must be judged in today’s macro reality of high interest rates, insurance spikes, and construction inflation that have depressed real estate activity nationwide, not blamed on ULA’s structure.

Bottom line: The measure is delivering a durable revenue engine in a hostile macro environment. That is success, not failure.

Claim 2: ULA has “built basically no housing” and spent “only $1.5 million”

The argument: Two years in, almost nothing has been delivered; therefore ULA does not work.

What the record shows: Development takes years in Los Angeles under the best of conditions. Even so, ULA has already begun construction on 795 affordable homes, including one building that opened earlier this year and three more nearly complete. That work has created 10,000 union jobs and is expected to produce 13,400 affordable units over the next decade. On top of that, the City just launched a $424.8 million spending program, 80% funded by ULA, to build and preserve affordable housing and keep Angelenos in their homes.

Meanwhile, ULA funding is producing immediate results where speed matters most: rental assistance and income supports have helped over 10,000 Angelenos stay housed. The program has also educated 100,000 tenants about their rights, funded Right to Counsel for renters facing eviction, and stepped up enforcement of the city’s anti-harassment law.

Bottom line: Counting only ribbon-cuttings ignores the pipeline ULA has unlocked and the near-term prevention gains that keep people out of homelessness today.

Claim 3: ULA is “redlining LA” by chilling multifamily and commercial deals

The argument: Apartment and commercial markets have “basically stopped,” and ULA is to blame.

What the record shows: Independent researchers have already discredited studies that pinned market slowdowns on ULA for ignoring broader conditions like high interest rates, rising insurance, and pandemic-era costs. Real-world data point the opposite direction: transactions subject to ULA have risen quarter by quarter, entitlements are up more than 50% since 2022, and in just six months this year developers filed proposals for over 17,000 new units under the Citywide Housing Incentive Program.

That surge makes clear what was really happening: developers were waiting for zoning reform (CHIP) to be finalized before moving forward. Once the rules were certain, they jumped in with applications. The rush also shows CHIP’s limits. Because single-family zones were excluded, the program’s potential was capped.

Most importantly, the entitlement flood proves it is not ULA that stalls development but uncertainty. Developers respond when the rules are clear. The real drag on the market is the constant lawsuits, political attacks, and rushed efforts to gut ULA, which spook investors and make everyone hold back. It’s a self-fulfilling slowdown: opponents manufacture uncertainty, then point to the hesitation they caused as supposed evidence the tax doesn’t work.

Bottom line: The 17,000-unit surge demonstrates that stable rules encourage building. The danger to development isn’t ULA’s tax, but the ongoing attempts to undermine it.

Claim 4: The $5 million “cliff” makes ULA uniquely harmful; it should be marginal

The argument: Because ULA isn’t a marginal tax, it distorts behavior and suppresses deals.

What the record shows: There is no evidence the cliff is causing systemic damage. High-value transactions continue and have trended upward as markets normalize. More importantly, voters chose a structure that asks those benefiting from very high-value sales—luxury residential and commercial—to contribute meaningfully to housing solutions. If technical refinements are worth exploring, they should be made locally and transparently, not used as a pretext to rip out ULA’s core.

Bottom line: The existence of a threshold is not proof of harm, and it does not justify weakening the measure.

Claim 5: ULA’s affordability covenants, “first-position” rules, and resale limits make projects unfinanceable

The argument: Lenders balk at ULA’s protections, so the money cannot be used effectively.

What the record shows: These are intentional safeguards to protect public investments and ensure long-term affordability, which is precisely what voters mandated. The solution to lender comfort is implementation tuning, not dismantling guardrails. The current pipeline proves adaptation is already happening. Hundreds of units have advanced, and the City has committed hundreds of millions more to production and preservation. Adjustments that improve bankability can and should be handled locally through program guidelines and stakeholder process, which ULA already uses via an active public oversight committee.

Bottom line: Protecting public value is a feature, not a bug. We should focus on fine-tuning implementation locally rather than weakening ULA’s core affordability guarantees.

Claim 6: Sacramento must step in or Jarvis will torpedo ULA and dozens of taxes statewide

The argument: Without a state “fix,” the Howard Jarvis Taxpayers Association will bankroll a 2026 repeal campaign and blow up local revenues across California; therefore ULA should be amended at the Capitol.

What the record shows: This is a false choice. The Jarvis effort is an ideologically driven anti-tax assault that will not be satisfied by carving out ULA. Any conversation about changing a voter-approved city initiative belongs in Los Angeles, not in a rushed gut-and-amend bill in Sacramento with no time for public input. When a late bill attempted to delay ULA taxes for 15 years on newer developments (an approach that would have stripped tens to hundreds of millions annually from prevention and production programs) broad pushback forced it to be pulled. The bill is slated to return, but that only reinforces why debates should remain local, legal, and transparent.

Bottom line: Do not trade away ULA’s impact to appease anti-tax hardliners. Keep decisions in LA, where voters created the measure and where stakeholders are already improving it.

The larger picture

Since ULA took effect, LA recorded its first drop in the homeless count in years, coinciding with ULA’s first two years. It now provides 80% of Los Angeles’s local affordable housing funds, more than double federal contributions and ten times county Measure A. Lawsuits have failed, implementation is accelerating, and the market is positioning for the next building cycle. Attempts to gut ULA now would drain funds from eviction defense, income support for seniors and disabled residents, anti-harassment enforcement, and the affordable-housing pipeline at the very moment these programs are scaling.

The choice is stark: Stand with a voter-mandated, steadily improving tool that keeps people housed and builds affordable homes, or side with a rush to weaken it based on contested analysis and a manufactured sense of urgency.